Section I, Planning for Yourself and for Your Beneficiaries, Continued

(4) Budgeting, Bill Paying & Bank Reconciliation

(A) Budgeting, Bill Paying & Bank Reconciliation

OK, everyone knows that they should prepare a monthly budget to organize their finances. If your budgeting and bank balance reconciliation efforts needs a little help, then hopefully, with a little guidance you too can be the master of your financial domain.

I. Budgeting

- How you determine your budget is based on the timing of your inflows of income, from whatever sources, and your outflows (expenses), basically when your bills are due without being late. This page will just cover a month by month scenario, so if your job is seasonal in nature, then your budgeting will require a squirrel method, whereat you bury your peanuts, acorns, etc. (save) in the summer and fall, then dig them up in the winter and spring. Or in other words, if you earn all of your income in a 6 month period, make sure that you save half of it for bills in those months when your income stops, or slows down. You can still use the budgeting tool described and provided below.

- I am assuming that if you are married, you have combined your finances. If you have not done this, stop what you are doing, and go do this. The 'till death-do-ye-part of things includes your money too. #TUNA.

- So, your first step is to determine how much income will come in for the month from all sources. Then, from past months figure out what your estimated monthly expenses are. If your income exceeds your expenses, this is good, and it is called savings, recreation, giving, etc. Write this all down.

- Frequency. Your pay dates may be monthly, semi-monthly, bi-weekly, or a combination of these if you are married, or have other income such as social security or other retirement distributions. I believe it to be a good thing to have two bill paying cycles. Mid month, and end of month. Of course, your particular circumstances could be different. I speak in general terms.

II. Bill Paying from your Budget

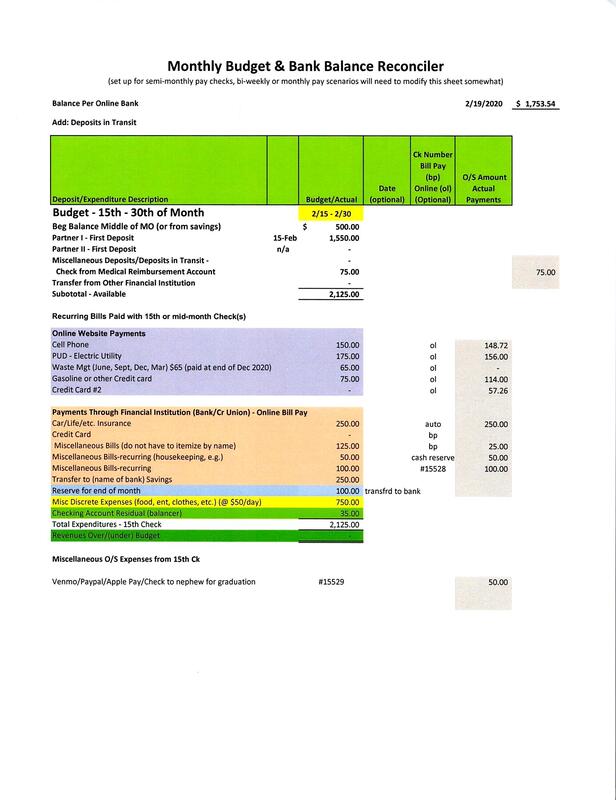

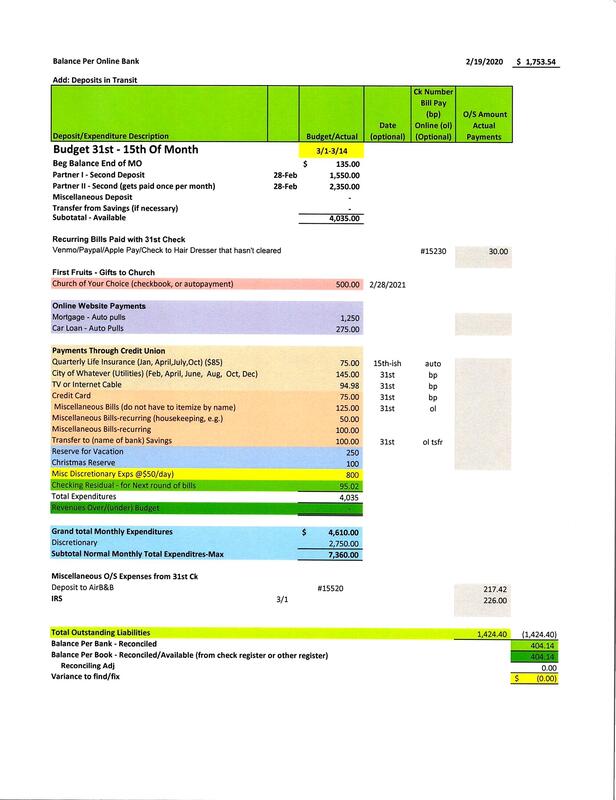

- Several Years ago, I created a tool called the Monthly Budget & Bank Balance Reconciler (MB&BBR), all in one convenient spreadsheet! OK, admittedly not that catchiness an acronyms. I have attached below a .pdf version, as well as an Excel file version. I populated it with some general bill paying categories, as well as some numerical figures so you can get the idea of how it operates. Click the links to access.

- So, the MB&BBR separates the month into two parts. The middle of the month, and the end of the month. You will have to look at when your bills are due to determine how to split them into two parts. Of course, you will have to modify the MB&BBR to your personal situation. Your goal here is map out a plan for every dollar you receive, including the dollars that you are going to save. Granted some of these dollars will be grouped into categories, such as "discretionary expenses". These "Misc. Discrete Expenses" are for groceries, eating out, entertainment, errand running, etc. It is the difference of what you earned, and what bills including savings that you paid out.

- Most bills are paid online these days. I use a mixture of the online Bill Pay from my checking account, paying bills directly from a vendor's website, paying some from set up autopayments (mortgage, car insurance e.g.), and occasionally by check & mail, which is rare. Find a method that works for you. Also important is to gather your bills in one area (manilla folder marked "Pending", e.g., or get notifications by email or text. The nice thing about having your pre-populated budget is that you can see payments coming, and if you do not get, or lose your statement, you can still pay the bill on time.

- For bills such as paying someone to mow your yard or other bills that come up during the semi-month cycle, but not on your bill paying day, make sure to reduce them from your checkbook balance & MB&BBR as though you paid them already, so your net amount of discretionary spending left for that cycle is net of all expenses for that period.

- I also recommend that you squirrel away a consistent amount with each paycheck to a separate bank account to fund a reserve account(s) for Christmas, Vacations, etc. Your employer may let you break your direct deposits into more than one account. (If not, make these transfers yourself). I have found that even if you put away $25-$150 per check, it is out of sight and mind, and by the time Christmas e.g., comes around, you have a wad of cash that you can spend guilt and debt free!

- A Note on Investing for Retirement

- Also, the MB&BBR is used to pay bills from your net pay. There is a category of "Transfer to Savings", but this is after you may have retirement contributions that are funding an employer sponsored plan. If your employer does not offer retirement plans (401k, 457b,403b, Roth, etc.), then this category could be used to participate in one on your own. Saving for retirement is a good habit to get into, and you can often times start with small amounts to get started ($25/mo., e.g.).

- There are pros and cons to pre-tax or after-tax (Roth) investing, either deferring your taxes now, but having a larger principal to grow, or in the case of a Roth, investing after-tax income, but your future earnings are not taxable. Consult with your financial advisor, or the representative who enrolls you into a plan, for advice for your particular situation. Both investment vehicles are good options, but most importantly, start early, and make consistent contributions. On a similar note, if your employer matches your contributions to your plan, make sure to take advantage of this to the extent you can. Free money!

- But, one caveat regarding investing for retirement. Focus on getting out of debt before funding a discretionary (non-employer) retirement plan. Nothing will keep you strapped for cash like owing on student loans, vehicles, credit cards, etc. Stop the borrowing and pay these off! Smallest to largest. (Dave Ramsey's Debt Snowball concentrates on the smallest debt first, disregarding interest rates. When that is paid off completely use those resources towards the next largest debt, and so-on). I did this, and it works and feels great! Your mortgage is in a different category, but make sure it is affordable. Dave Ramsey recommends no more that 25% of your take home pay.

- One exception to this would be to taking advantage of an employer-matched savings plan. Free money.

III. Bank Reconciler Tool

Also included in the MB&BBR is a bank reconciling tool:

- -You start with the Bank Balance on top.

- -Add any deposits you may have made that the bank doesn't see yet.

- -Then keep the expenses that you have made but have not cleared the bank yet in that column (which reduces the balance per bank).

- -From your checkbook balance (balance per book), add or subtract any items from the bank statement (or online detail) shows but you do not (interest, check order fees, etc.).

- -Compare the calculated total with the total from your checkbook (I know many just rely on the online bank balance #:^(, (none of that for us!).

- -Variances to these two balances must be ratted out, and may be in the form of duplicated expenses, missed payments, mis-recorded payments, deposits, etc., etc. When the variance is 0$, pat yourself on the back because you rock!

- -Sometimes, time and energy do not allow balancing to the penny. Small mysterious adjustments can be made to balance out, and hopefully the next time you balance (can be daily, weekly) things will be back to a $0 variance.

Final Words regarding Budgeting & Bill Paying

Even if you don't end up using the MB&BBR or similar tool, at least sit down each month and map out your budget. It will help you prioritize your spending, saving and giving in such a way that it will give you peace of mind, or in some cases give you some positive anxiety that you need to change your behaviors to become more financially stable and successful. Don't be intimidated, keep at it and it will become second nature.