Section III - Budgeting, Bill Paying & Other Financial Situations for your Parent

Bill Paying

At this point, your parent's financial responsibilities are now yours. And as such, the same principles apply from Section I (4) Family Finances, Budgeting, Bill Paying & Bank Reconciliation and Section I (5) Financial Recordkeeping, with the following additional suggestions and unsolicited advice:

Passwords

Make sure to have a list of all of your parent's passwords, and keep it in a secure place. Your parent may or may not have had the savvy to do anything online, but if they did, or if you have established any login credentials on behalf of them, just make sure that you have them written down. This is especially helpful if they pass away and you have to access any of their accounts during your executorship, if you are so named.

Budgeting

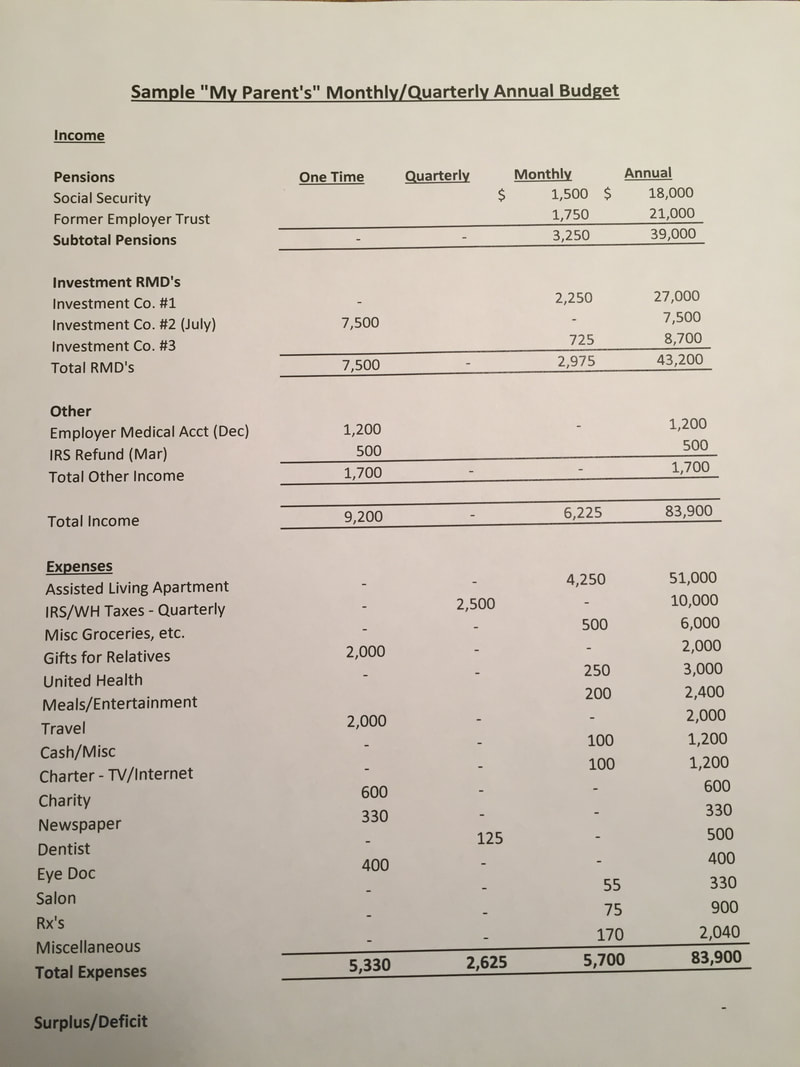

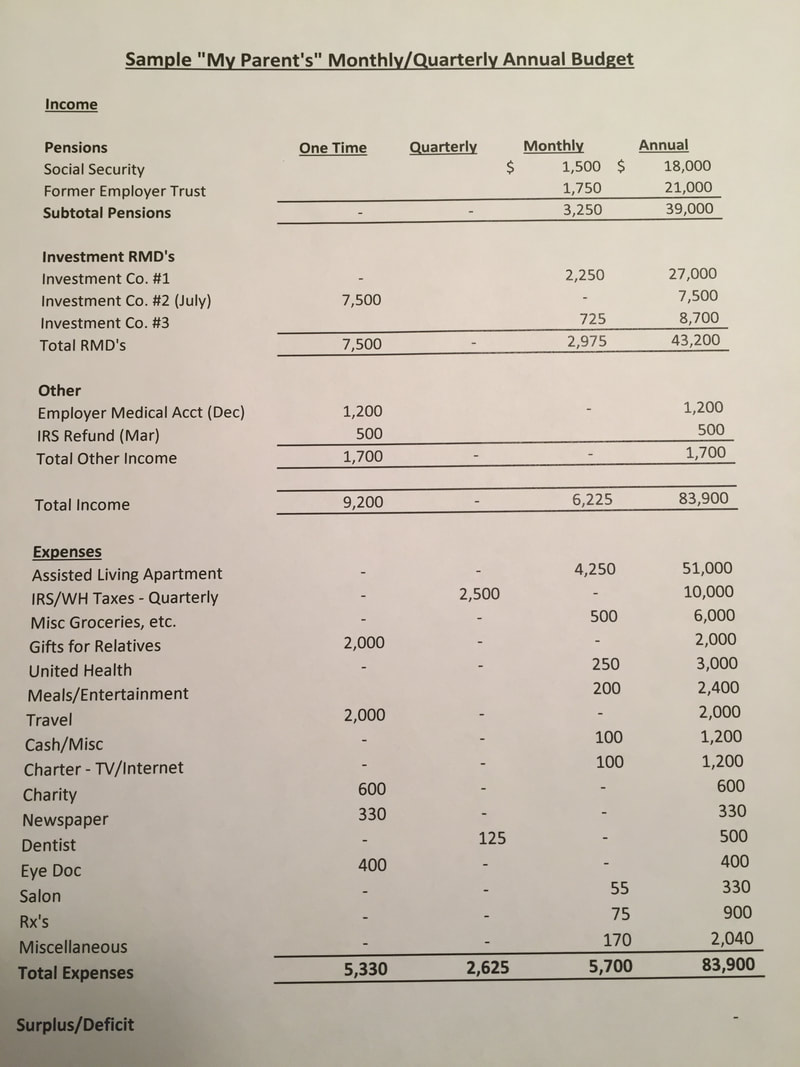

In addition to a monthly budget, first draw up an annual budget (a sample budget suggestion found below in .pdf and Excel file format). An annualized budget will give you a good picture of your parent's overall financial situation. You may have to go through their checkbook records and online banking activity to collect this information. Also, regarding the state of bill paying affairs, you might have to make some decisions now as to contributions to charities, political organizations, birthday gifts to grandchildren, etc.

Bill Paying

At this point, your parent's financial responsibilities are now yours. And as such, the same principles apply from Section I (4) Family Finances, Budgeting, Bill Paying & Bank Reconciliation and Section I (5) Financial Recordkeeping, with the following additional suggestions and unsolicited advice:

Passwords

Make sure to have a list of all of your parent's passwords, and keep it in a secure place. Your parent may or may not have had the savvy to do anything online, but if they did, or if you have established any login credentials on behalf of them, just make sure that you have them written down. This is especially helpful if they pass away and you have to access any of their accounts during your executorship, if you are so named.

Budgeting

In addition to a monthly budget, first draw up an annual budget (a sample budget suggestion found below in .pdf and Excel file format). An annualized budget will give you a good picture of your parent's overall financial situation. You may have to go through their checkbook records and online banking activity to collect this information. Also, regarding the state of bill paying affairs, you might have to make some decisions now as to contributions to charities, political organizations, birthday gifts to grandchildren, etc.

It could be that your parent lives in an assisted living environment, and has just a few bills to manage. It this situation, a monthly budget may be unnecessary, but you will still want to make sure the checkbook regularly reconciles to the online or paper bank statements.

Like operating your own business, keep your parent's financial information separate from yours. It could be that your parent needs your monetary financial help, and if this is the case you may want to assimilate their finances completely into your own. If you have to do this, close all of their bank accounts and treat them as you would a dependent child. There could be tax implications as well regarding their dependency.

Investment Management

Depending on the age of your parent, and their type of investments, you have to make sure that their RMD's (Required Minimum Distributions) are being met. Basically RMD's are the IRS's way of getting their taxes back from before-tax investments such as 401k's, 403b's, 457b's e.g., IRS guidance here. Each year some actuary down in the IRS's basement will figure out how long your parent (and you too) has to live, statistically, and amortize their pre-tax nest egg accordingly. You can probably set the RMD's up with the investment companies and forget it going forward. Distributions can happen monthly, or even annually depending on the stream of payments that works best for you.

Simply stated, you cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach a certain age. Beginning in 2023, the SECURE 2.0 Act raised the age that you must begin taking RMDs to age 73. If you reach age 72 in 2023, the required begining date for your first RMD is April 1, 2025, for 2024. IRS guidelines on Required Minimum Distributions can be found at this link.

Last Notes on RMD's

Other investments such as stocks and mutual funds (a collection of stocks in a managed fund) may not have to be accessed to live on. This type of wealth can be "generational", and can be left alone for your heirs. You may also want to buy a yacht or a villa in Italy with these funds, if that is your thing. Sure. Tax strategy (avoidance) may play into your decisions as well. There are some good YouTube videos on the subject on utilizing retirement incomes most advantageously. A good idea too to consult a financial advisor.

Social Security

Social Security benefit payments are received monthly, and may be taxable (within certain limits) depending on your other incomes. Medicare insurance is deducted from it as well. You will also need supplemental insurance to Medicare, as discussed in Section I - Health Insurance.

The timing of when to take social security can be complicated as various factors come into play such as the immediate need of income and lifetime expectancy. You can elect to receive social security at age 62, but your lifetime monthly income may be quite a bit lower than if you wait to receive it until 65, 67 or even 70 years of age. Between age 67 and 70 for most people reading this, your benefit will increase 8% per year until the age of 70. But, remember, you will receive the higher amount for a shorter period of time.

Many pundits these days recommend waiting as long as you can (up to 70). When I do the rough math, the break-even age between 62 and 67 (my "official IRS retirement age") is about 80 years old, not factoring any compound interest or Cost of Living Adjustments (COLA's - that have averaged 1.65% over the last ten years) that I would hypothetically receive if I just invested it. When you factor in age 70, you may hit the mid-80's to break even.

I have seen/read some advice that would have you receiving the smaller of the two spouses social security at age 62, then taking the higher wage earner's (over the previous 35 years) benefit at age 67-70. Every situation is different, so contacting a financial advisor to make this decision may be the best option.

If you, or your surviving spouse expect to live a long life (85+ years, say), then it may make sense to wait until 67-70 to begin receiving one or both of your benefits. But remember, if you elect to wait, and you die before you received any benefits, then you have made the wrong decision. Also, you will probably be more active during your 'younger' years, so you could use the money for travel, e.g., but conversely, you may need more income in your golden years to help with the costs of assisted living. Humph!

If one of your parents precedes the other, they will only receive the larger of the two monthly payments until they die.

In closing, although this social security discussion may belong under Section I, as you may or may not play a role in your parent's social security decisions, other than manage it like any other income, this discussion may help you start thinking about when to start receiving the benefits when it is your turn.

Taxes

You are now responsible for your parent's tax return. Make no mistake, the IRS does not care about your retirement status. Most income is taxable until the day you die, and even after that in regard to their estate after they pass. See Section III Executorship for that. Find your parent's last tax return to help you in these tasks.

So, if you are able to, just complete their returns on TurboTax, or other software, or bring your parent's taxes to your tax professional if that is how you roll. As a separate entity from you, you will prepare them as you would for yourself, including names, addresses, PIN's, bank routing & account numbers, etc.

One other note and mentioned in the section linked in the above paragraph (Executorship), you will need the TurboTax Business edition to prepare the tax return (1041) for the Estate that you set up after your parent's passing. You can prepare their "while living" (for a portion of the year) return (1040SR) with regular TurboTax (at least the 'Premier' version). Curiously these final tax returns have to be mailed in instead of being filed electronically.

So, on this note, your parent's stream of incomes (pensions, social security, investments, etc.), may or may not have federal withholding taken out of them. But do not despair, because the IRS has a vehicle for this. The 1040-V. The Payment Voucher. Conveniently, the IRS will send you a package of quarterly vouchers and envelopes. You will need to estimate your parent's annual tax burden that is not withheld as mentioned above, and send in this amount, on a quarterly basis. If your retirement income(s) withhold for taxes, the 1040-V should not be necessary.

Like operating your own business, keep your parent's financial information separate from yours. It could be that your parent needs your monetary financial help, and if this is the case you may want to assimilate their finances completely into your own. If you have to do this, close all of their bank accounts and treat them as you would a dependent child. There could be tax implications as well regarding their dependency.

Investment Management

Depending on the age of your parent, and their type of investments, you have to make sure that their RMD's (Required Minimum Distributions) are being met. Basically RMD's are the IRS's way of getting their taxes back from before-tax investments such as 401k's, 403b's, 457b's e.g., IRS guidance here. Each year some actuary down in the IRS's basement will figure out how long your parent (and you too) has to live, statistically, and amortize their pre-tax nest egg accordingly. You can probably set the RMD's up with the investment companies and forget it going forward. Distributions can happen monthly, or even annually depending on the stream of payments that works best for you.

Simply stated, you cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach a certain age. Beginning in 2023, the SECURE 2.0 Act raised the age that you must begin taking RMDs to age 73. If you reach age 72 in 2023, the required begining date for your first RMD is April 1, 2025, for 2024. IRS guidelines on Required Minimum Distributions can be found at this link.

Last Notes on RMD's

- You can withdrawal more than the minimum required amount

- Your Withdrawals will be included in your taxable income except for any part that was taxed before (your basis) or that can be received tax free (such as qualified distributions from designated Roth accounts).

Other investments such as stocks and mutual funds (a collection of stocks in a managed fund) may not have to be accessed to live on. This type of wealth can be "generational", and can be left alone for your heirs. You may also want to buy a yacht or a villa in Italy with these funds, if that is your thing. Sure. Tax strategy (avoidance) may play into your decisions as well. There are some good YouTube videos on the subject on utilizing retirement incomes most advantageously. A good idea too to consult a financial advisor.

Social Security

Social Security benefit payments are received monthly, and may be taxable (within certain limits) depending on your other incomes. Medicare insurance is deducted from it as well. You will also need supplemental insurance to Medicare, as discussed in Section I - Health Insurance.

The timing of when to take social security can be complicated as various factors come into play such as the immediate need of income and lifetime expectancy. You can elect to receive social security at age 62, but your lifetime monthly income may be quite a bit lower than if you wait to receive it until 65, 67 or even 70 years of age. Between age 67 and 70 for most people reading this, your benefit will increase 8% per year until the age of 70. But, remember, you will receive the higher amount for a shorter period of time.

Many pundits these days recommend waiting as long as you can (up to 70). When I do the rough math, the break-even age between 62 and 67 (my "official IRS retirement age") is about 80 years old, not factoring any compound interest or Cost of Living Adjustments (COLA's - that have averaged 1.65% over the last ten years) that I would hypothetically receive if I just invested it. When you factor in age 70, you may hit the mid-80's to break even.

I have seen/read some advice that would have you receiving the smaller of the two spouses social security at age 62, then taking the higher wage earner's (over the previous 35 years) benefit at age 67-70. Every situation is different, so contacting a financial advisor to make this decision may be the best option.

If you, or your surviving spouse expect to live a long life (85+ years, say), then it may make sense to wait until 67-70 to begin receiving one or both of your benefits. But remember, if you elect to wait, and you die before you received any benefits, then you have made the wrong decision. Also, you will probably be more active during your 'younger' years, so you could use the money for travel, e.g., but conversely, you may need more income in your golden years to help with the costs of assisted living. Humph!

If one of your parents precedes the other, they will only receive the larger of the two monthly payments until they die.

In closing, although this social security discussion may belong under Section I, as you may or may not play a role in your parent's social security decisions, other than manage it like any other income, this discussion may help you start thinking about when to start receiving the benefits when it is your turn.

Taxes

You are now responsible for your parent's tax return. Make no mistake, the IRS does not care about your retirement status. Most income is taxable until the day you die, and even after that in regard to their estate after they pass. See Section III Executorship for that. Find your parent's last tax return to help you in these tasks.

So, if you are able to, just complete their returns on TurboTax, or other software, or bring your parent's taxes to your tax professional if that is how you roll. As a separate entity from you, you will prepare them as you would for yourself, including names, addresses, PIN's, bank routing & account numbers, etc.

One other note and mentioned in the section linked in the above paragraph (Executorship), you will need the TurboTax Business edition to prepare the tax return (1041) for the Estate that you set up after your parent's passing. You can prepare their "while living" (for a portion of the year) return (1040SR) with regular TurboTax (at least the 'Premier' version). Curiously these final tax returns have to be mailed in instead of being filed electronically.

So, on this note, your parent's stream of incomes (pensions, social security, investments, etc.), may or may not have federal withholding taken out of them. But do not despair, because the IRS has a vehicle for this. The 1040-V. The Payment Voucher. Conveniently, the IRS will send you a package of quarterly vouchers and envelopes. You will need to estimate your parent's annual tax burden that is not withheld as mentioned above, and send in this amount, on a quarterly basis. If your retirement income(s) withhold for taxes, the 1040-V should not be necessary.